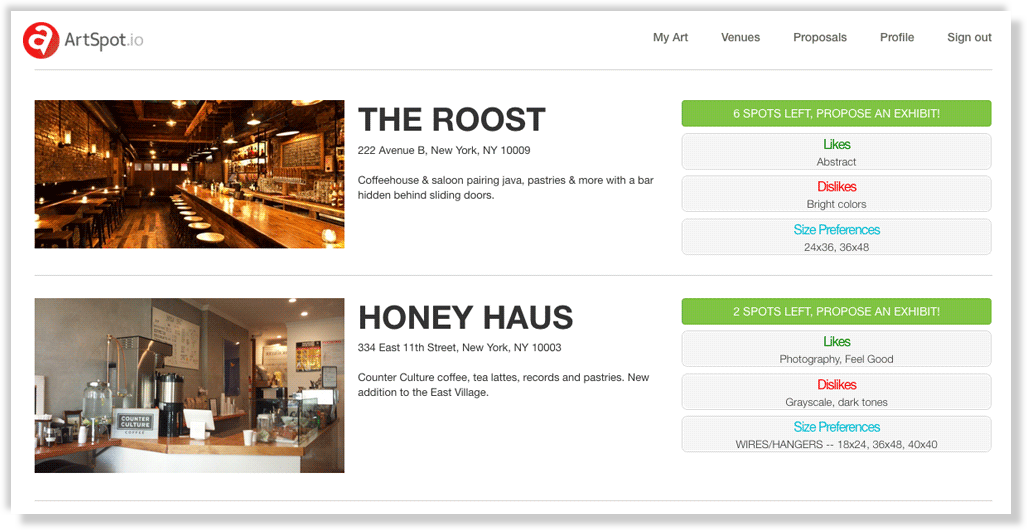

in 2013 i started a company — ArtSpot.

our platform connected indie artists in New York City with local venues who displayed their work.

from appearing on my first podcast interviews to raising money, managing developers and wire-framing product ideas, i learned a lot.

building the ArtSpot team

i recruited a French intern, Laurent, who developed a replicable door to door sales model for the world’s toughest prospects — bar and restaurant managers.

we found a pro art dealer, Grace, who leveraged her connections across the globe to identify up and coming talent for the art side of the marketplace.

and to build the product on a shoestring (i didn’t know how to code), i organized “hack nights” at my studio apartment where friends Jason, Michael, and Alex came over for 6-packs of Stella and Domino’s pizza.

we even rented a venue in the Lower East Side for 3 days, hosting our own gallery to a packed opening night complete with wine, music, and journalists.

ArtSpot was one of the coolest things i’ve done, but ultimately, i failed to succeed it as a business.

there are always losers

when i shuttered ArtSpot on Christmas day, 2014, it was easy to feel both bummed and self-righteous.

“is this all my fault? what if the team members worked harder? should i have changed our sales pitch?”

one thing i didn’t think about, however, was the sentiment of my investors.

probably because company shut-downs, aka the end of the road for investors, are simultaneously new beginnings for the entrepreneur.

that one deal they were rooting for, bragging about to friends and colleagues, and always available to have a quick phone call about?

dead.

everybody’s a winner

the entire time i ran ArtSpot, i knew it wasn’t my last startup.

i knew that even if we grew and achieved our vision to becom the world’s largest [zero asset] art gallery, it wouldn’t be enough.

today, after a few years of lessons learned, i’m thinking about the net impact a single investment makes on an entrepreneur.

- investor puts $$$ into Company

- Company fails/succeeds

- founder pursues New Company, leveraging $$ or experience from #1/2

- repeat

see, the combined experiences of Company A, B, C, and D are what enabled my current hits [1,2,3].

put another way, the cash invested in my earliest ventures (ie: ArtSpot) was both the most expensive and most risky:

- i didn’t know how to build a team or technology

- the driving purpose behind each project was to “not have a boss”

- undercapitalized, i freelanced to keep co’s afloat (lack of focus)

- hadn’t yet read 100 great books

but these investors took a chance on me anyway, paying my tuition for later success without any strings attached.

so why not give credit where it’s due… let’s give Company A investors a return.

putting it all together

this week i paid back all my ArtSpot investors, plus 4 years’ interest, on the 3 year anniversary of shutting down the company.

the mental and emotional benefits from them believing in me in 2013 had a tremendous impact on why and how i “do what i do” today, fortunately at a higher win rate.

i can’t guarantee i’ll do this for every failed project, but it’s been a pleasure making my inaugural investors whole again.

they say you only get to make a first impression once.

i call bull.

As one of the initial investors, I can attest to this being the best Christmas present I got this year. Class move by Ryan. Anyone that knows him well enough would tell you that whether or not Ryan had paid me back, I would always be all ears for any opportunity to be involved in a business venture with Ryan. The decision to pay everyone back out of his own pocket further exemplifies Ryan’s character and reminds me why I make an effort to try and surround myself with the right people in business, as well as in life. Merry Christmas bro…… maybe I’ll take your gift and buy bitcoin?!?!!!?!?

Yeah right.